The Malaysia SST registration or application process is carried out online via the MySST portal. You collect GST from your customers on the sale of your goods or services.

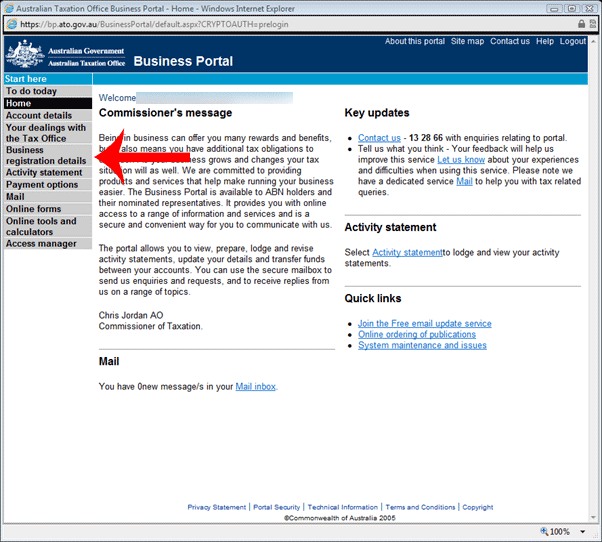

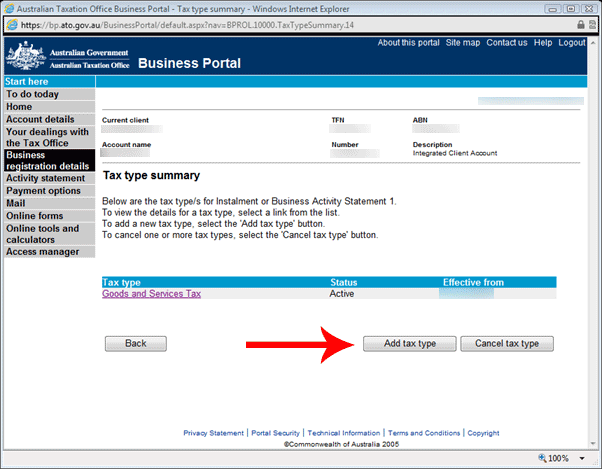

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

. Registering for Malaysias GST Is there a sales registration threshold. Charge GST to your customers. The registration forms can be obtained from the nearest Customs office or on-line from GST portal or websiteAll the documents relating to the business or companies registration should be submitted upon request.

A taxable person who is mandatory to be registered under GST Act can complete the application by submitting the prescribed form GST-01. For example you make payment to vendors and you must also pay bank fees to banks. Management services and other charges in connection to the provision of management services including project management or project coordination.

Per Malaysia GST regulations GST will be applied to the bank charge. For GST registration purpose the method to use for computing taxable turnover depends on the business set-up eg. GST was only introduced in April 2015.

The developer joint management body or management corporation to the owners of a building held under a strata title. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and. GST Registration Application Status.

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. You maintain it in the address information for your legal entity. What happens if you dont register for GST.

A registered person is required to charge output tax on. What does this mean exactly. Pay any GST you owe to us.

If your business annual sales do not exceed this amount you are not required to register for GST. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person. As announced by the Government GST will be implemented on 1 April 2015.

Through your registered tax agent or BAS agent. Step by step guide on how to register for Malaysian GSTOnline GST Registration Guide by SQL Accounting MalaysiaThe government is sponsoring 1000 e-voucher. The bank will provide a GST invoice to.

Their data will be transferred to create the SST Malaysia registration. Yes Malaysia has an annual sales registration threshold of MYR 500000 based on local sales. By phone on 13 28 66.

You pay GST to your suppliers when you buy goods and services relating to your taxable activity. Enter the GSTIN Number. Once registered for GST you need to.

GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. Go to GST Portal. When filing your GST return you work out.

The application processed through this system for GST registrants. Once you have an ABN you can register for GST. This can be a calculation of sales in the last.

The businesses already registered with the GST dont need to register again for SSTSales and Service Tax. Asset and fund managers. You can order a form using our online publication ordering service.

Well the threshold amount refers to your total sales in the country during any 12-month period. The two reduced SST rates are 6 and 5. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

Via Online services for business. It applies to most goods and services. Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500000 or more oblige to be registered under the GST.

By completing the Add a new business account NAT 2954 form. To ensure a smooth implementation of GST businesses are encouraged to submit their application for early registration. The GSTSST registration number is printed on your tax invoices and some reports.

Related information can be found and downloaded from these. If you dont register for GST and are required to you may have to pay GST on sales made since the date you were required to register. To determine whether your business obliges to register for GST a calculation is made base on.

GST Registration Application Status. RMCD is ready to accept application for registration from 1 June 2014.

How To Apply For Gst And Pan For A Partnership Firm Ebizfiling

Online Sole Proprietorship Registration In India Sole Proprietorship Sole Business

Step By Step Guide To Apply For Gst Registration

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

Step By Step Guide To Apply For Gst Registration

Administering The Value Added Tax On Imported Digital Services And Low Value Imported Goods In Technical Notes And Manuals Volume 2021 Issue 004 2021

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Gst Registration Check How To Check Gstin Validity Indiafilings

Restaurant Pos Software Restaurant Management System Bar Pos

Pin By Uncle Lim On G Newspaper Ads Ads Corporate Design

Step By Step Guide To Apply For Gst Registration

Look What I Found On Aliexpress Kids Grocery Store Supermarket Design Cash Register

Step By Step Guide To Apply For Gst Registration

Registering For Gst Video Guide Youtube

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Point Of Sales System Malaysia Online Pos Software Cashier Machine Restaurant Pos Pos Terminal Cash Register Sql Accounting Sst Tax Invoice Simple Pos

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

How To Register For Gst Gst Guide Xero Sg